In many production departments, units are typically transferred from the initial stage to the next stage in the process. When the units are transferred, the accumulated cost per unit is transferred along with them. Since the unit being produced includes work from all of the prior departments, the transferred-in cost is the cost of the work performed in all earlier departments. In reconciling total units into production with the total units transferred out/still in process, it is not uncommon for there to be a shortfall. The reason is that many processes may involve scrap, waste, or spoilage (e.g., evaporation, spilling, etc.). Waste and spoilage would be added as a third component needed to balance the lower portion of the quantity schedule column.

Why You Can Trust Finance Strategists

For example, a manufacturer may produce 10,000 units of a product, but only 8,000 units are fully completed. The EUP for the 2,000 partially completed units can be calculated to determine the cost per production unit. It requires tracking the units at each production stage and applying conversion factors to determine the equivalent number of completed units. Actual units produced is a simpler method, as it only requires tracking the number of fully completed units.

Best Practices for Accurate Calculation of Equivalent Units of Production

Equivalent units are calculated by multiply the number of physical units in work in process by the estimated percentage of completion of the units. Once the cost per EU is calculated, the costs are allocated to the goods that were partially finished and completely finished during the period. It is a little different, however what are the branches of accounting how they work when there is a beginning and ending number of units that have been partially finished. These goods in process must have costs allocated to them along with the goods that were finished during the period. In this case, the equivalent production for opening work-in-progress in the period is 300 units (i.e., 500 x 60%).

Discover more from Accounting Professor.org

For example, forty units that are 25% complete would be ten (40 × 25%) units that are totally complete. In this illustration, Navarro is assumed to use the weighted-average costing method (other approaches such as FIFO could be used). This simplifies the process because the beginning inventory and current period production can be combined or “averaged” together. First, we need to know our total costs for the period (or total costs to account for) by adding beginning work in process costs to the costs incurred or added this period.

Equivalent Units of Production Formula

Accountants have devised the concept of an equivalent unit, a physical unit expressed in terms of a finished unit. The choice between FIFO and weighted average methods also affects inventory valuation. FIFO tends to reflect more recent costs, which can be beneficial in periods of rising prices, potentially leading to higher reported profits. Conversely, the weighted average method provides a more smoothed view of costs, which can be advantageous in stabilizing financial statements. These differences underscore the importance of selecting an appropriate cost allocation method that aligns with a company’s financial goals and market conditions.

- At the end of process 1, our planners have their paper and ink ready to be printed.

- In production, units completed in a period is equivalent to units that got into the finished goods or work-in-progress.

- The \(1,750\) ending WIP units are \(100\%\) complete with regard to material and have \(1,750 (1,750 × 100\%)\) equivalent units for material.

- It is a crucial metric to determine the cost of goods sold and inventory value in a production environment.

- See this article from Forbes that explains the difference among cost, worth, and value to learn more.

Accounting for partially completed units

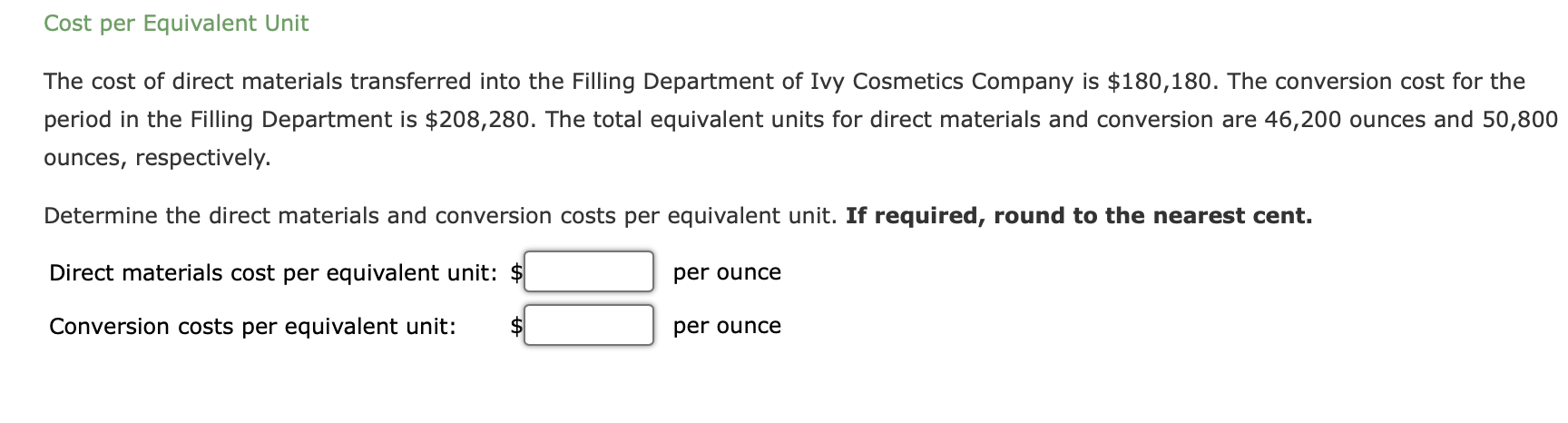

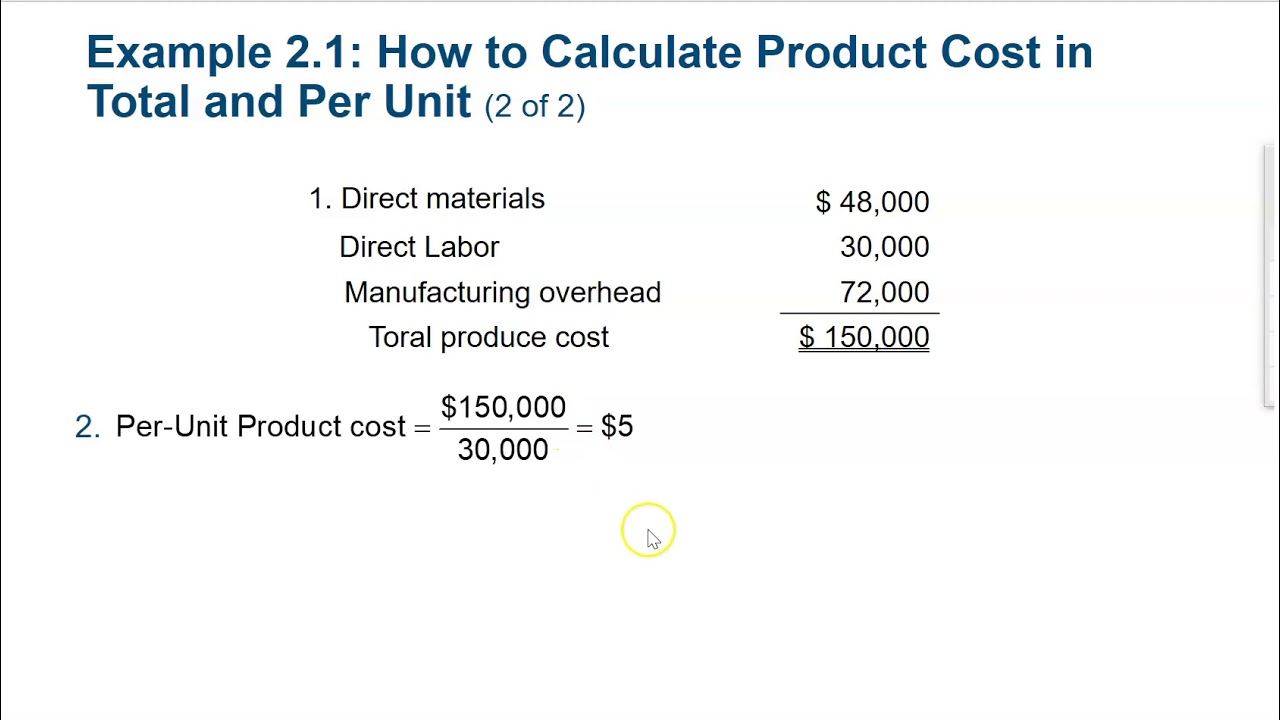

The following example is used to demonstrate how the equivalent units of production are used to allocate production costs between completed and partially completed units. The equivalent production for each department is determined, which is later used to calculate the cost per unit of each job order by apportioning their total costs on basis of equivalent units. The variations in calculating equivalent production units in different industries reflect each sector’s unique characteristics and challenges. Regardless of the industry, however, using equivalent production units is valuable for measuring and managing production processes and costs. For example, forty units that are \(25\%\) complete would be ten (\(40 × 25\%\)) units that are totally complete. The equivalent unit calculations are carried forward into the “cost per equivalent unit” schedule.

An equivalent unit of production is used in accounting and manufacturing to measure the output of partially completed units of production in terms of fully completed units. As with calculating the equivalent units and total cost of production in the initial processing stage, there are four steps for calculating these costs in a subsequent processing stage. This alignment is particularly impactful in sectors like petrochemicals, textiles, and pharmaceuticals, where production scales are vast and continuous. By translating partially completed work into equivalent units, businesses can achieve a more accurate reflection of resource consumption and production output.

For example, knowing the number of partially completed units can help managers decide which products to prioritize for completion and which ones to delay or discontinue. The shaping department completed \(7,500\) units and transferred them to the testing and sorting department. No units were lost to spoilage, which consists of any units that are not fit for sale due to breakage or other imperfections. Since the maximum number of units that could possibly be completed is \(8,700\), the number of units in the shaping department’s ending inventory must be \(1,200\).

Often there is a different percentage of completion for materials than there is for labor. As described previously, process costing can have more than one work in process account. Determining the value of the work in process inventory accounts is challenging because each product is at varying stages of completion and the computation needs to be done for each department. Trying to determine the value of those partial stages of completion requires application of the equivalent unit computation. The equivalent unit computation determines the number of units if each is manufactured in its entirety before manufacturing the next unit.